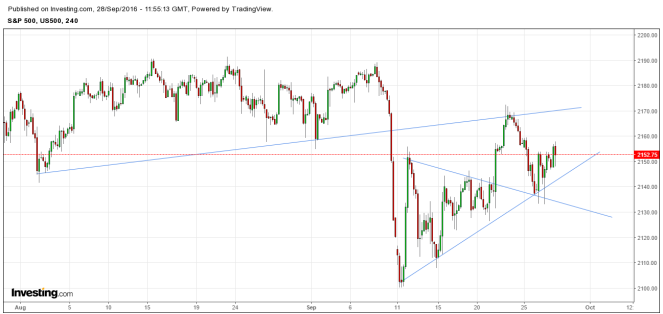

After a nervous opening where we initially saw post-debate overnight rally erased, US equity markets steadied and posted modest gains to end the day with SPX up 14pts. Volatility is on snooze until the next major events and the VIX likely continue to fill gap at 12.5. Broader markets should continue its relief rally until then.

Looking at the DIA, which once again held bullish trendline from beginning of the year, likely grind towards strong resistance near 184 where abandoned baby doji and broken wedge.

Plenty of central bank jawboning today, as later at 10am EST, Fed Char Yellen will testify and Bullard will speak. Also to follow is ECB’s Draghi at 10:30am before several other Fed members will speak throughout the day. Though, I would not expect them to say anything new or different enough to cause the trading range in US equity markets to break. Meanwhile there will be the much-watched OPEC meeting at the same time which for sure cause some volatility in crude oil. Snooze on that one as well until we break the LT wedge one way or the other.

The stock that is catching everyone’s attention these days is no doubt Twitters (TWTR) with all the buyout rumors from Microsoft and Disney. This has fueled a massive squeeze and confirmed breakout from inverse H&S pattern. Not much technical resistance at least until 25 area.

Day Ahead – Events and Economic Data

| Time | Event / Data | |

| 8:30am | Durable Goods | |

| 10am | Fed Chair Yellen Testifies

OPEC Meeting |

|

| 10:30am | ECB President Draghi Speaks |

Quantitative Strategy – Automated Portfolio Update

Performance

| ASSET CLASS | TYPE | LONG/SHORT | DAILY RETURN % | MTD % | YTD% |

| Equities | Short-Term | Long Only | |||

| 0.26% | 1.28% | 46.63% | |||

| Short Only | |||||

| 0.09% | 1.21% | 33.25% | |||

| Long/Short | |||||

| 0.16% | 1.22% | 41.39% | |||

| Medium-Term | Long Only | ||||

| 0.41% | 1.01% | 20.68% | |||

| ETF | Short-Term | Long Only | |||

| -0.44% | 4.73% | 30.92% | |||

| Short Only | |||||

| 0% | 3.59% | 8.32% | |||

| Long/Short | |||||

| -0.44% | 4.30% | 29.70% | |||

| Medium-Term | Long Only | ||||

| 0.50% | 3.16% | 25.45% | |||

| Futures | Short-Term | Long/Short | |||

| 0.08% | 2.73% | 6.09% | |||

| FX | Short-Term | Long/Short | |||

| 0% | 3.18% | 15.11% | |||

| SPX | Benchmark Index | ||||

| 0.64% | -0.51% | 5.67% | |||

Portfolio Commentary

We are seeing some good technical setups in Financial and Information Technology stocks. Yesterday we got into XLF and GS, and today our quant signal added MS which looks a compelling setup on the weekly chart. There are many momentum plays in Tech sector as we observe many breakouts. For example, WDC, NVDA, STX are prime examples which we are already long. Today we also added TWTR which is a momentum play for continued near-term strength after breaking inverse H&S pattern last week.

Utilities and REITS are weak despite strength in Treasuries, and will be under more severe pressure should the relief rally in rates peters out. Energy is weak as well, and we remain long only in select quality stocks.

Chart in Focus

MS – Short-Term & Medium-Term Long

Target: 34.8

Entry Point(s): 30.7, 31.35

Comments: Retested horizontal breakout and worked off short term overbought conditions. In medium term should continue march towards late 2015 swing point of near 35 area.

TLT – Medium-Term Short

Target: 131

Entry Point(s): 139

Comments: It is our conviction that this rally in bonds is temporary after Fed kept rates on hold, but should resume downside in the next quarter.

Day Trading Charts & Parameters

Futures

Dow 30

Support: 18040 Resistance:18388

S&P 500

Support: 2133, 2143 Resistance:2170

NDX 100

Support: 4807,4840 Resistance:4890, 4920

Comment: Back up above breakout line, now looks to test recent highs.

Crude Oil

Support: 44 Resistance:46

Gold

Support: 1307-1315 Resistance: 1343

10-Yr Treasury Note

Support: 131.1 Resistance: 132.15

Nikkei 225

Support: 16150 Resistance: 16745, 16800

Currency Pairs

USD/JPY

Support: 99, 100

Resistance: 102.25

EUR/USD

Support: 1.1150

Resistance: 1.1254

GBP/CHF

Support: 1.2600

Resistance: 1.2700,1.2750